School Spotlight: St. Jerome’s School, Maplewood, MN

March 24, 2025

School Spotlight: Saint Raphael Catholic School

April 17, 2025Ways to Give: QCDs

We hope you find this new Ways to Give series informative and helpful as you consider the many ways you can support Aim Higher Scholars. The Aim Higher Foundation does not provide tax or legal advice, and as such, this series is presented purely for informational purposes. We ask that you always consult with your professional financial and legal advisors.

Gifts of Retirement Assets

Plan for year-end now

If you are at least 70-and-a-half years old, there are tax advantages with a gift from an IRA. A Qualified Charitable Distribution (QCD) from an Individual Retirement Account (IRA) directly to a charitable organization avoids the income tax that one would owe on a regular withdrawal. If you have a Required Minimum Distribution (RMD), the QCD gift will count toward that RMD.

A popular recommendation is to execute a QCD early in the year to avoid any conflict with the “first-dollars-out rule.” The first dollars withdrawn from an IRA are deemed to count toward the RMD. Once an RMD is taken, it cannot be retroactively offset with a later QCD.

If you would like to make arrangements for a QCD gift or would like to set up a meeting with Aim Higher’s Advancement Team, please call our office at 612-819-6711.

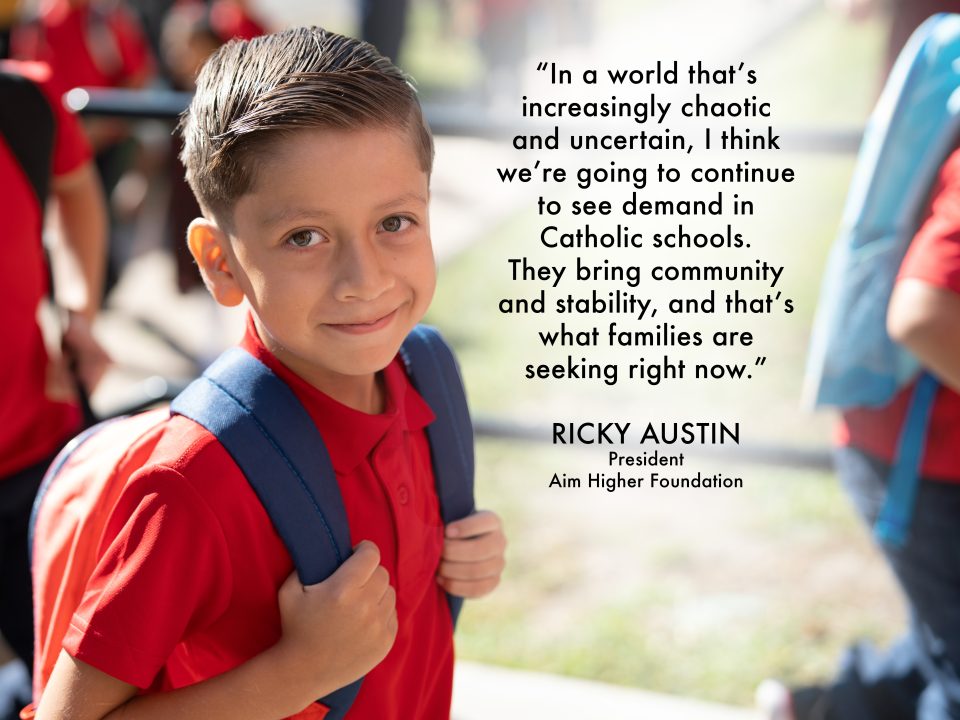

We appreciate your partnership as we strive to open more doors for more families seeking the life-transforming benefits of Catholic education. Your generosity – your yes – is changing lives.